Feeling the Squeeze

I’m not a mortgage broker.

Which has meant that I’ve managed to avoid too many conversations with people about the rapid increase in interest rates over 2022/23.

In fact, for many of my retiree clients, those conversations have taken on a guilty/happy tone more than anything else. (When you have no debt and lots of savings, increasing interest rates are great – but you can’t really crow about it without upsetting a lot of people).

However, through my work with the (excellent) brokers at The Loan Gallery, I’m increasingly discussing the pressure of rising interest rates with people gritting their teeth through it.

And, hats off to the brokers out there – these conversations can be tough.

The Cliff

We heard a while back about the looming ‘cliff’ of low-fixed-rate mortgages expiring and coming into today’s variable rates.

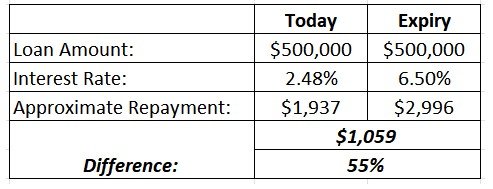

I was speaking with somebody today and here’s what a difference it’s going to mean for them:

The good news for them is that the property they own is worth much more than their mortgage – but that doesn’t change the fact that they’re going to need to find another $1,059 in their monthly budget when things change.

They have other resources – which is why we’re talking; to start modelling out their options well in advance of the change – but even so, this is a significant change for them.

The Investors Would Like a Word

I’ve been criticised in the past for taking a pretty conservative approach to real estate investment.

And when the market’s booming, that’s fair enough – conservatism quickly resembles cowardly ignorance when the markets leaping ahead 20% a year.

But one of the reasons for my stubborn caution with property investment is that it’s just so damned expensive. It’s a big, lumpy purchase of an asset that has fixed characteristics that present challenges when the market turns.

After all, you can’t sell one room to cover the loan repayments for a while.

That doesn’t make property investing bad – not at all. A lot of people have made a lot of money with property in Australia.

However, it does mean that purchasing an investment property should be a deliberate, intentional decision that adheres to strict risk management principles.

Take, for instance, another person we’re doing some work with who’s coming up on the same fixed-interest cliff we’re talking about.

Except they’re property investors too.

So they have two other properties, all of which were bought when interest rates were down near the historical bottom.

They’re not alone in feeling the squeeze now, as rates rocket through the 3% buffer most lenders used in those golden times – but some numbers might help explain my gut conservatism a bit more.

So they have two other properties, all of which were bought when interest rates were down near the historical bottom.

They’re not alone in feeling the squeeze now, as rates rocket through the 3% buffer most lenders used in those golden times – but some numbers might help explain my gut conservatism a bit more.

All of which means that, when the loans reset to this higher rate, their overall position is going to go from being ahead by $349 per month to being negative $2,500 each month.

Which, for most people, is a source of real stress.

What Did They Do Wrong?

And when people are stressed about their finances, they tend to reflect on the choices that led them there to see what they did wrong.

But, ultimately, in this case – they didn’t really do anything wrong.

Sure, in hindsight, armchair experts can nitpick and say they ‘should have’ allowed a greater interest rate buffer, they should have made sure they had cash put aside, they should have done this, this and that.

But sometimes the market just goes against you.

The school of investing is a tough teacher because, often, the whole class can do the same thing, but depending on when they started, they’ll experience different results.

One benefit, though, is that investing is based on cold, hard numbers – and for some people, the facts are simple:

- Make changes, or lose.

Options

Thankfully, there are still options around for people being pushed towards the cliff.

Do Nothing (Head In The Sand)

The inclusion of this option should absolutely not be seen as an endorsement!

Because while it is possible to just ignore this looming problem for as long as possible, the reality is that, at some stage, the brick wall of reality will spring up and you’ll drive right into it.

But, in theory, these people could just sit tight and hope things will change.

Maybe rates will fall – sharply – before they get to the cliff. Maybe they’ll receive a stupendous raise at work. Perhaps the tenants will come and ask for a 20% increase in their rents…

And, yeah, maybe these things will happen.

But the idea of planning is to prepare for what happens if they don’t.

Do Nothing Drastic (Deliberately)

Another option is to consciously not take any drastic action.

The difference here is that this decision is made after careful consideration of the financial reality of their situation.

Some people will cut their expenses right back to ensure they can hold on to these properties. In fact, many people will do just about anything to keep their property portfolio together.

But they’ll avoid taking any big, drastic actions.

Instead, they might try increasing the rents, picking apart costs, revisiting how the tax benefits are structured, to finding extra work to cover the shortfall.

The upside of this option is that they will come out of this part of the cycle with their property portfolio intact.

The downside is that nobody knows how long this cycle might last – so white knuckling the whole time could really take a toll.

Sell Something

While the table above might appear a little nightmarish to some people (that level of debt would unnerve many a cautious investor), the upside is that this portfolio of assets means that they have options about what to do.

One of those choices could be to sell something – either Home, Property 2 or Property 3.

In doing so, they could release enough equity to bring down the remaining loans to the point where the leap in rates doesn’t have as big an impact.

For instance, say they sold Property 2. They’d have to pay Capital Gains Tax on the increase in the value of the property, plus they’d have to repay the loan and any other fees and charges.

Say they walk away with $100,000 from it all. Then they have choices.

- Do they split it across the other two loans?

- Do they park it on the Home mortgage only?

- Do they put it aside to help cover the increased repayments while they grit their teeth through this high part of the cycle?

This amount could cover 46 months of the additional loan repayments – this would likely be enough time to see them through this period.

While selling the property probably isn’t an ideal outcome – real property wealth tends to come over decades, not months – the fact that they can means that they have options.

Sell Everything

The final option is to sell everything.

Sell all three properties, take the residual amount (after fees, taxes, repaying the loans, everything) and step into the next part of life.

This is, clearly, an extreme step to take and I would strongly recommend obtaining independent advice before even starting down this path.

You need to know:

- The merits of the individual properties (are they likely to grow in the medium-to-long term, can you increase the rent, are there ways to decrease costs, etc).

- The after-tax position (Capital Gains Tax can be a hassle – even if you’re only paying it after you’ve made money – but there are circumstances where the loan repayment plus the tax bill can exceed the sale amount.

This dreadful situation is why you should obtain tax advice before taking such drastic action.

- What are your likely ‘next step’ options? Will you buy back into the same market? Will you sit tight? If so, for how long/until when?

- What are the transaction costs involved? Stamp duty’s always an unwelcome visitor here in Victoria, but there can be other costs you should be aware of before doing anything.

Make an Intentional Decisions

It might be hard to see just what the point of this post is. After all, we all know that this cliff is looming. We all know that actions will be required. That decisions will have to be made.

Which is why I’m writing this – decisions will need to be made, and I encourage you to make them deliberately, with intention and after carefully reviewing your options.

Each situation is so unique that it’s impossible to say what you should do in your individual circumstances – there is no one-size-fits-all answer, unfortunately.

But I can say that you should be frequently reviewing your financial situation and making decisions based on your circumstances, your needs and your reality.

This part of the cycle is a difficult part and nowhere near as fun as the part where money was cheap.

However, with an intentional approach and decisive action – as needed – things will work out.